Auto depreciation calculator for taxes

Residual Value how much this vehicle will be worth at the end of your. This avoids an issue where the customer would have to pay an additional fee if the depreciation of the car ends up higher than expected over the lease period.

Pros And Cons Paying Your Mortgage Off Early Part 3 Hold Up There Are A Credit Card Che Mortgage Payment Calculator Mortgage Payment Credit Cards Debt

TurboTax Self-Employed Online tax software is the perfect tax solution for independent contractors freelancers and business owners for preparing your income taxes.

. Depreciation Expense Book value of asset at beginning of the year x Rate of Depreciation100. Vehicles last longer as well as auto loans Cars SUVs Trucks last a lot longer than they used to. Get accurate auto lease payment pricing on any car at Edmunds.

Price of the Car - the total amount the dealership is charging for this vehicle. Kenya Car Import Duty Calculator Step 1. This can be used as a MACRS depreciation calculator.

How much car can I afford. Section 179 deduction dollar limits. How to Calculate a Lease.

The first advantage is that the purchaser does not shoulder. Property contained in or attached to a building other than structural components such as refrigerators grocery store counters office equipment printing presses testing equipment and signs. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

The first-year limit on depreciation special depreciation allowance and section 179 deduction for vehicles acquired after September 27 2017 and. The IRS refers to the gain that specifically relates to depreciation as unrecaptured section 1250 gain. The first calculator figures monthly automotive loan payments.

Is Depreciation Tax Deductible. To help you see current market conditions and find a local lender current Redmond auto loan rates are published in a table below the calculator. First the additional first year depreciation deduction percentage was increased from 50 to 100 percent.

The IRS taxes part of your gain as capital gain and it taxes the depreciation-related portion at a higher rate. After a few years the vehicle is not what it used to be in the beginning. Above is the best source of help for the tax code.

MACRS Depreciation Calculator Help. This means that any gain you earn from selling your property will incur both capital gains taxes and other taxes. Four years later when the borrower has paid off the loan the car may be worth only 2000.

Additional first year depreciation deduction provisions in section 168k additional first year depreciation deduction. The Auto Lease Calculator can help estimate monthly lease payments based on total auto price or vice versa. Every dollar you deserve.

To calculate an auto lease you need to think about several factors. Free car lease payment calculator - calculate your monthly lease payment. The amount of value the vehicle loses over time in this case the life of the lease.

As a good rule of thumb repairs tend to run close to 100 or so per month on average though it can vary significantly based on the vehicles age and. Under this system depreciation can be calculated using the declining balance method or the straight line method. If the borrower has neglected to take good care of the car it might be worth substantially less.

Please select and fill out details of your vehicle below. The second calculator helps you figure out what vehicle price you can afford for a given monthly loan payment. You will probably agree that selling it for 20000 again would not be especially fair you have some sort of a gut feeling that it is worth much less now.

The capitalized cost minus depreciation equals the. A walk-away lease is an auto lease which allows the lessee to return the car at the end. The calculator will estimate the capitalized cost lease price residual value the depreciation and lease fees the monthly payment without taxes and the monthly payment after the tax is applied.

2019 IRS Publication 946. Second the property eligible for the additional first year depreciation deduction was expanded for the first time to. Down PaymentDrive-Off FeeCapitalized Cost Reduction a sum of money you pay upfront toward the value of your car.

This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. Add the monthly depreciation and the monthly interest then multiply this figure by the tax rate to get. In the simplest terms depreciation is the decrease in valueImagine that you bought a car for 20000.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Free and easy-to-use automated calculator which quickly estimates your monthly car loan payments helps you figure out how expensive of a car you can afford to buy given a set monthly budget. Depreciation recapture is assessed when the sale price of an asset.

Car Loan Calculator. At the time of purchase the car is worth about 10000 minus fees and taxes. Compare auto loan rates and discover how to save money on your next auto purchase or refinance.

The average auto loan hit a record of 31455 in the first quarter of 2018 with the. Depreciation recapture is the gain received from the sale of depreciable capital property that must be reported as income. How to Depreciate Property.

IQ Calculators hopes you found this depreciation schedule calculator useful. Most leases are of this type. We however recommend you contact a clearing agent to assist you in confirming the taxes payable for importing the car of your choice.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022. What is Costcos Auto Program. Depreciation limits on cars trucks and vans.

100000 miles used to be considered a pretty good indication. Yes depreciation is an income tax deduction. AUTO KENYA The Trusted Name in Vehicle Shipping to East Africa.

The additional first-year limit on depreciation for vehicles acquired before September 28 2017 is no longer allowed if placed in service after 2019. It depends on how much the signage costs. The process of a car losing its value over time is known as depreciation.

We are the number one. If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. Depending on market conditions cars may depreciate between 10-30 the first year.

While this calculator allows people to estimate the cost of interest and depreciation other costs of vehicle ownership like licensing fueling repairs automotive insurance are not included. The yearly depreciation of a car is the amount its value decreases every year. Factoring in taxes and depreciation.

Normally a cars value is correlated with the price it has on the market but on average a car has a depreciation around 15 to 20 per year. An auto loan early payoff calculator like this one can help you figure out how much. They can potentially be deducted from taxes which is particularly beneficial for small business owners and the self-employed.

Real Estate Lead Tracking Spreadsheet

Five Star Luxury Limo Service Inc Limousine Black Car Service

Projected Profit And Loss Account In Excel Format Profit And Loss Statement Statement Template Spreadsheet Template

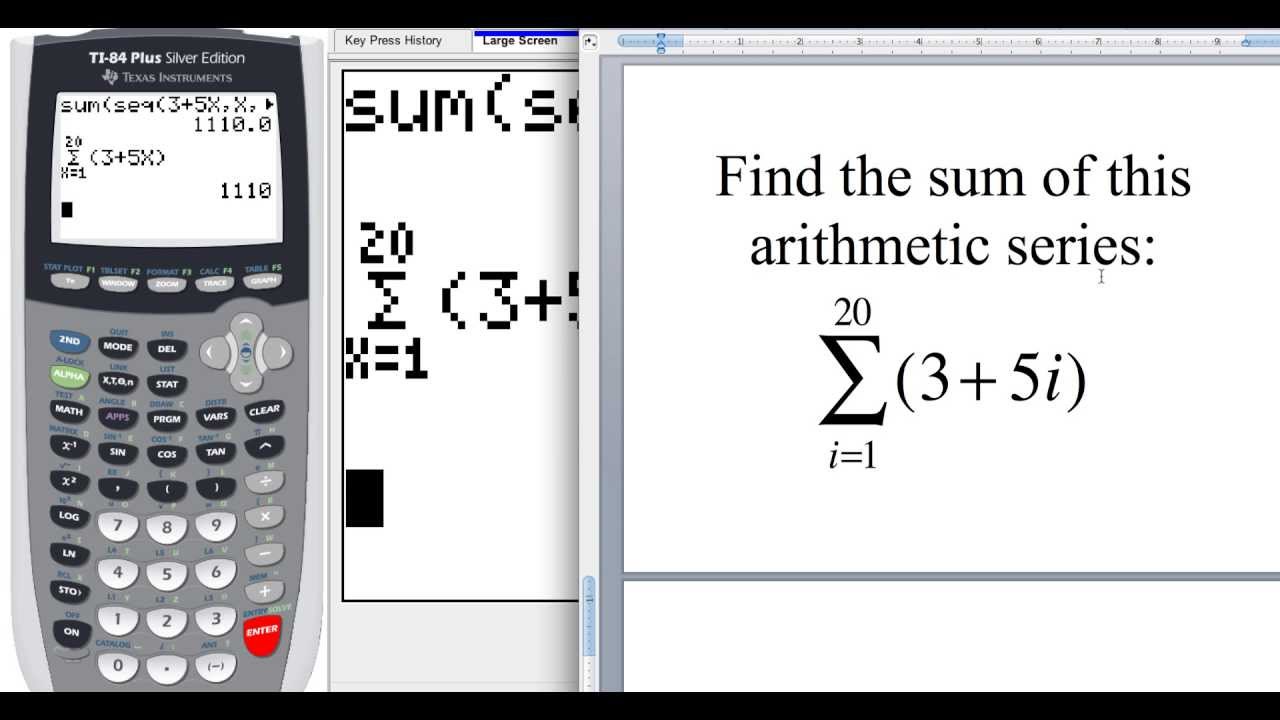

12 2 How To Find The Sum Of An Arithmetic Sequence On The Ti 84 Precalculus Graphing Calculators Arithmetic

The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeping Business

Pin Em Cost Of Goods

Accountantteams I Will Do Bookkeeping In Quickbooks Online And Xero Accounting For 10 On Fiverr Com Bookkeeping Services Bookkeeping Credit Score

Mileage Log Template For Taxes Luxury Vehicle Mileage Log James Orr Real Estate Services Door Hanger Template Templates Custom Door Hangers

12 2 How To Find The Sum Of An Arithmetic Sequence On The Ti 84 Precalculus Graphing Calculators Arithmetic

What Is The Average Amount Paid For Auto Insurance In The United States Affordable Car Insurance Best Car Insurance Cheap Car Insurance

Cash Flow Projection Template Flow Chart Template Cash Flow Cash Flow Statement

So You Like That Leased Car So Much That You Want To Buy It Now Here S How Car Loans Car Car Title